The Bailout Bonus Recovery Tax

Hope to stop the bonus payments seems slim. According to AIG, they are contractually obligated to pay these “bonuses”. If AIG can't stop itself from giving away tax payers' money, the government should move quickly to recover it.

My suggestion is that Congress moves quickly to pass the “Bailout Bonus Recovery Tax.” It would be a one-time tax increase this year only. It would be a 90% tax on any bonus over $50,000 from a company which had to be bailed out by the government. I feel a limit of $50,000 will make sure the tax only affects the traders and managers which made the bad decisions and ruined their companies. It seems only fair that if companies are using tax payers' money to pay huge bonuses, that the government should impose huge taxes on those bonuses.

Truth About Value

Would Nationalize By Any Other Name Not Sound So Scary?

Never have I seen an idea move so quickly from the fringe to the mainstream. While three months ago only a few people were even discussing the possibility of nationalizing some of the failed banks, it is now getting serious coverage. Some Republican lawmakers and publications like the Economist and Newsweek have started to openly talk about the possibility.

The fact that at least a few of the worst banks will be nationalized now seems inevitable. Already some banks have received more TARP money than they are now worth. President Obama has even acknowledged that Sweden's nationalization of their banks in the 90's is so far the best model for how to deal with the problem.

It seems that the greatest obstacle to nationalizing the banks is the term nationalization. For decades, the right has turned both socialism and nationalization into four letter words in American politics. This means that Obama's most important objective in dealing with bank crisis is to invent a new name for nationalization. Below is a list of my favorites. Do not be surprised to see one of these names (or something similar) picked up by the White House in the coming weeks:

Structured Bankruptcy

Managed Bankruptcy

Managed Restructuring

Receivership

FDIC Takeover

Temporary FDIC Directorship

Temporary FDIC Management

FDIC Directed Reorganization

FDIC Restructuring

Reorganization

Managed Reorganization

Forced Reorganization

Managed Liquidation

Directed Management Reorganization

Nationalize to Save Capitalism

40 Years in the Wilderness?

The second piece of the coalition is the muscular neo-conservative wing. They are pro-military voters. Since 9/11, they have been willing to create massive increases in government power to combat terrorism. They not only believe that America should use force to promote democracy around the world but that we have a moral imperative to. The Iraq war has completely discredited the neo-conservatives. The fast, cheap war of liberation we were promised never materialized. Instead we got a long, bloody, and expensive occupation. After 5 years and nearly a trillion dollars, we may be able to leave Iraq as a highly divided semi-stable country.

Finally, there are the small-government fiscal conservatives. Over the past eight years the Bush administration has managed to turn a budget surplus into a huge deficit. Two expensive foreign wars have drained our treasury. While these moves have bothered the fiscal conservatives, they could be explained as necessary consequences of 9/11. But in the past few days the Bush administration has destroyed the Republican moral authority to small government and sound fiscal policy. The federal reserve just spent $250 billion to nationalize our banking industry, along with another $500 million to be spent buying up bad loans from large financial institutions. A president which only a year ago claimed we couldn't afford to (or just shouldn't) spend $35 billion to provide health care for kid is willing to spend a trillion dollars bailing out AIG, Bear Stearns, Fannie Mae, and the financial sector.

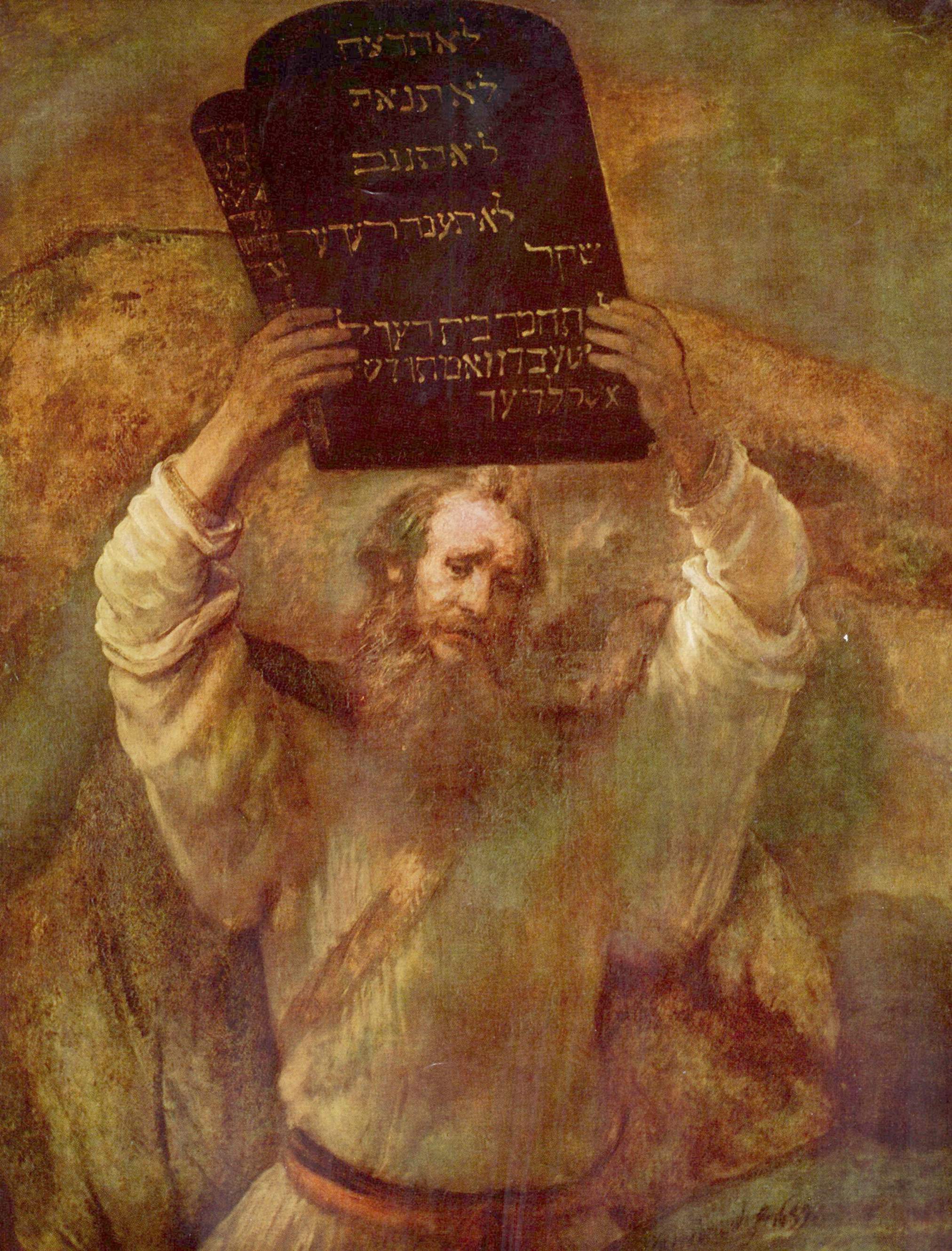

The Republican party has not just failed independent and moderate voters but its own party faithful as well. Many planks of its platform have been discredited or abandoned. While evangelical voters remain loyal, they are neither numerous enough nor geographically diverse enough to support a national party on their own. It is known that the Republican party is headed for its second straight election of huge losses. What is not known is how long the Republicans will be lost wandering in the minority party wilderness. The Republican party needs a Moses to create a new coalition to lead them into the promised land. Who their Moses will be and what commandments he will bring will be the political question of the early 21st century.

The Only New Regulation We Really Need

I call the regulation the “you broke it, you pay for it” rule. The rule is simple: If any business needs to be bailed out with taxpayer money, all top executive (CEO, CFO, President, Vice President, Etc...) must pay to the government every single dollar they earned from their failed company. The rule will affect any top executive who ran the company in question during the 3 years leading up to the bailout. If an executive is unable to pay back all the money he or she earned, they must forfeit all their assets. I'm not a monster-- executives who can't pay should be left with a net worth no greater than $500,000. That is more than generous. With this rule in place I picture a dramatic reduction in the number of companies the federal government needs to bail out.